Examine This Report on Business Owner's Policy (BOP Insurance) - BizInsure

The 3-Minute Rule for What Is a Business Owners Policy?

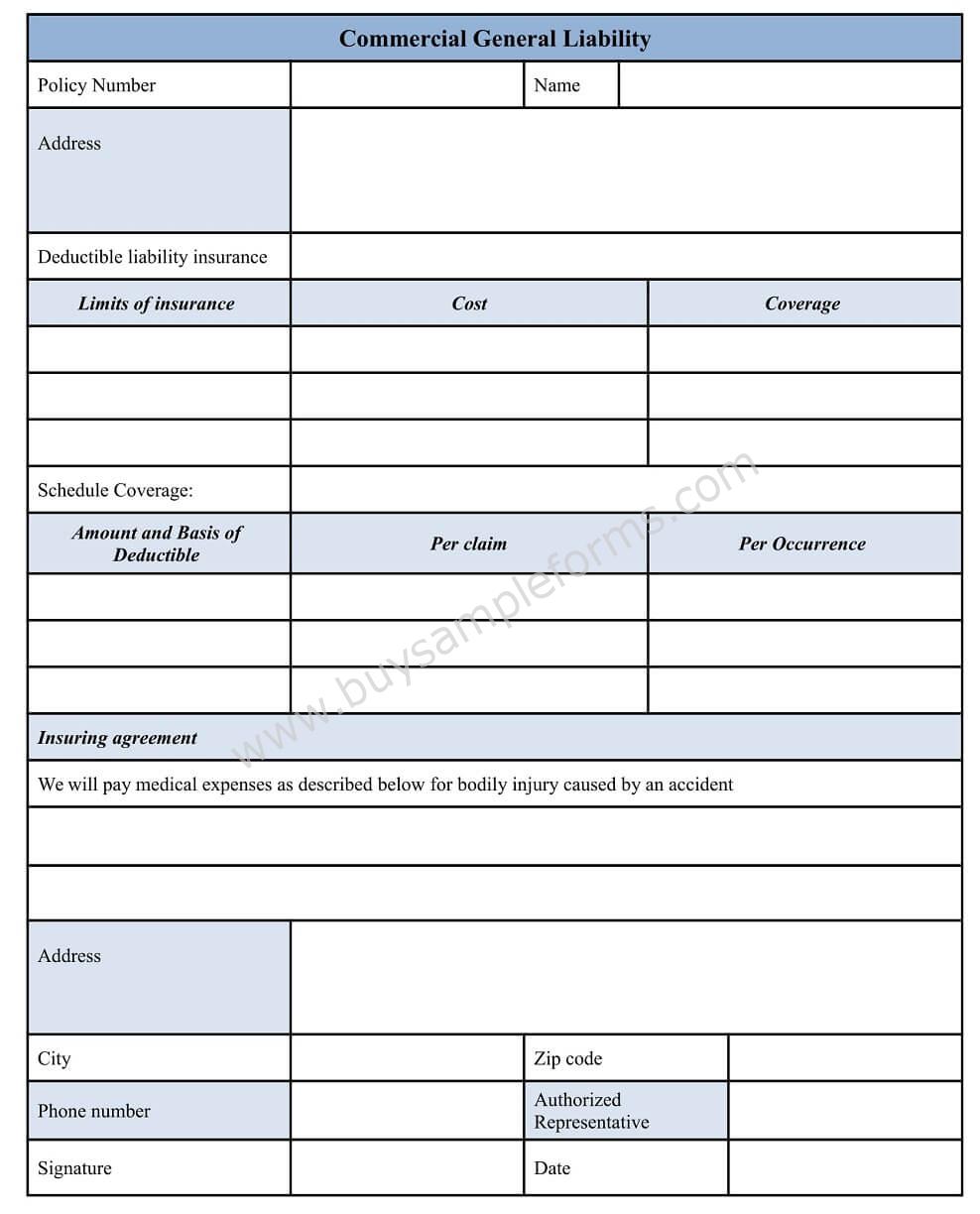

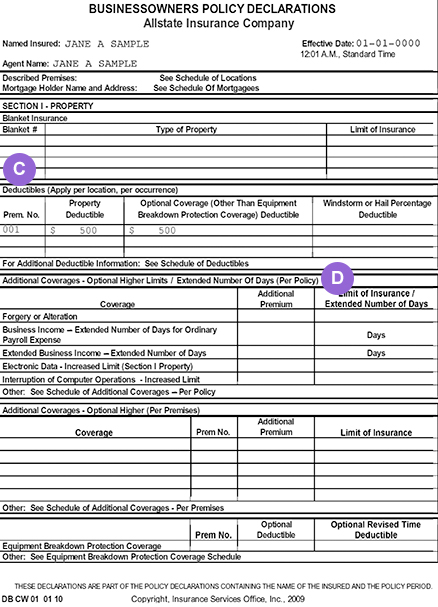

An organization owner's policy supplies basic liability coverage and likewise spends for damage or loss of your building, devices, and stock. Organizations that communicate with the general public depend on a basic liability policy to cover third-party lawsuits over physical injuries and residential or commercial property damage. But this insurance coverage doesn't offer protection for fire, theft, and other occurrences that damage or damage your property.

Business Owner's Policy (BOP): What It Is, How to Get One - NerdWallet

That makes it a smart option for small company owners. Find out more about picking in between the two company insurance plan. How does a BOP protect your business? A BOP can spend for your legal fees during a suit. It likewise covers repair or replacement of harmed or lost property. Here are a couple of situations where home organizations, freelancers, and small companies gain from this policy: Home based business, Freelancer, Small service, Liability security, A courier journeys on your unequal deck while providing a bundle and sues over the injury.

Your business lease requires general liability insurance coverage. Marketing injury defense, A rival implicates you of libel after you share an uncomplimentary post on social media. A professional photographer demands copyright infringement after you use a licensed image on your website. A class-action suit accuses your organization of failing to protect your customers' right to privacy.

The Of What does a business owners policy (BOP) cover? - Insurance

A criminal steals your computer. Severe weather damages your workplace building. How do you get proof of basic liability insurance coverage? PBIB Insurance can normally get proof of insurance coverage online on the same day you start a company owner's policy through Insureon. It can take a number of weeks for a traditional insurance coverage company to send a certificate of business liability insurance to brand-new clients.

Business Owners Policy Insurance

With Insureon, you can rapidly supply evidence for the lease or contract you're preparing to sign. How much does a business owner's policy cost? This is based on the median cost of a service owner's policy. And 12% of Insureon's small organization consumers pay less than $33 each month for this policy.

What is Independent Contractor Insurance? - Small Business Insurance, Simplified

Service owner's policies are flexible. You can add additional protections, likewise called endorsements, to your BOP insurance to fulfill your particular requirements. Many services bundle their BOP with other coverage alternatives: (also understood as service earnings insurance) covers loss of earnings and additional costs when there is a short-lived disruption in your service operations.